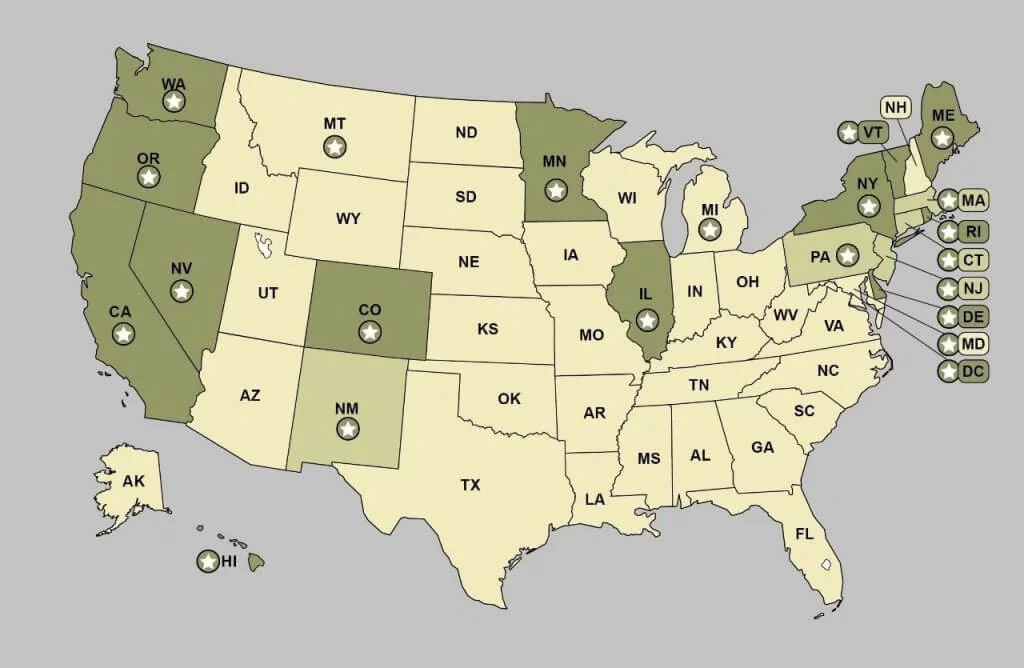

States With No Income Tax 2024. 1, several state tax reforms have gone into effect that can impact your finances. In addition to federal income tax, most states also collect state income tax.

Nine states — alaska, florida, nevada, new hampshire, south dakota, tennessee, texas, washington and wyoming — have no income taxes. 1, several state tax reforms have gone into effect that can impact your finances.

But Not All States Were Created.

Best online tax software providers of march 2024.

There Are Currently Nine States That Do Not Have A Personal Income Tax Or Tax On Capital Gains:

Take arkansas, which is reducing its top marginal rate to 4.4% in 2024, from 4.7% last year.

As Of 2023, The States With No Regular Income Tax Are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, And Wyoming.

As of 2023, the states with no regular income tax are alaska, florida, nevada, new hampshire, south dakota, tennessee,.

Images References :

Source: www.ramseysolutions.com

Source: www.ramseysolutions.com

Which States Have No State Tax? Ramsey, States currently have no state income tax whatsoever: These are the 11 states that tax social security benefits in 2023 and are expected to do the same in 2024:.

Source: www.marca.com

Source: www.marca.com

Tax payment Which states have no tax Marca, February 23, 2023by bassey jamesleave a comment. In addition to federal income tax, most states also collect state income tax.

Source: www.taxuni.com

Source: www.taxuni.com

States Without Tax 2023 2024, Currently, seven states—alaska, florida, nevada, south dakota, tennessee, texas, and wyoming—don’t levy income taxes on individuals. 16 states with income tax cuts in 2024.

:max_bytes(150000):strip_icc()/9StatesWithoutAnIncomeTax-8930504a78a94618b205ffd70dc03928.png) Source: www.thebalancemoney.com

Source: www.thebalancemoney.com

US States With No Tax, 1, several state tax reforms have gone into effect that can impact your finances. Best online tax software providers of march 2024.

Source: www.compareremit.com

Source: www.compareremit.com

9 US States That Don't Charge State Taxes, Two states tax only interest and dividend. The standard deduction for single filers rose to $13,850 for 2023, up $900;

![Top 9 States with No Tax in 2020 [Free Guide]](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/12-States-with-No-Income-Tax-for-Retirees-768x768.png) Source: www.realwealthnetwork.com

Source: www.realwealthnetwork.com

Top 9 States with No Tax in 2020 [Free Guide], In the united states, there are currently seven states that do not have a state income tax. Social security recipients are required to pay state taxes in addition to federal taxes unless they live in one of the 41.

Source: entrepreneur.com

Source: entrepreneur.com

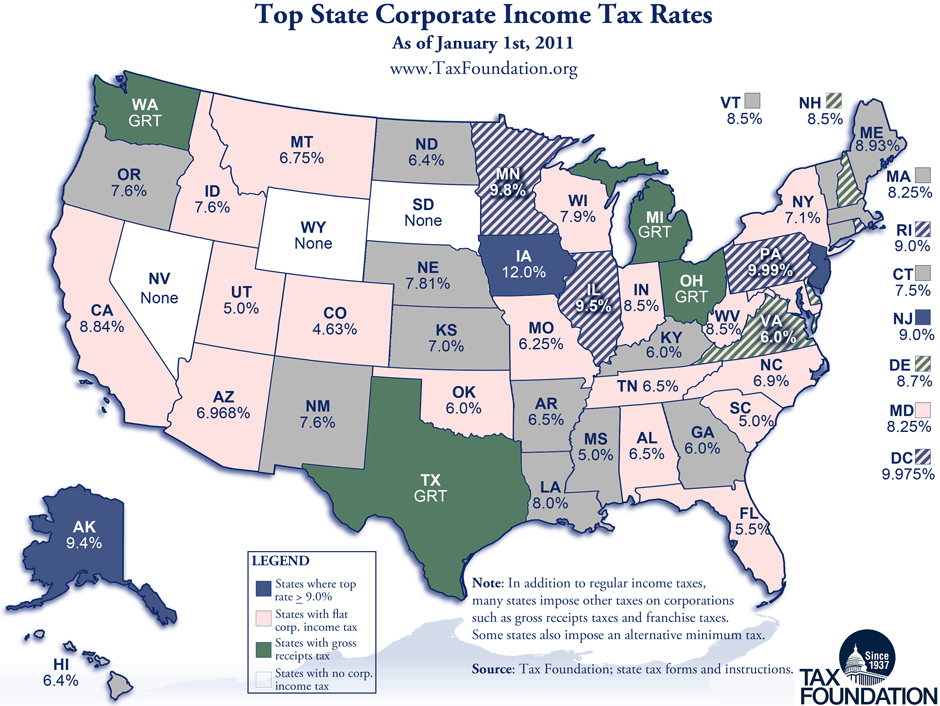

States With the Lowest Corporate Tax Rates (Infographic), There are currently nine states that do not have a personal income tax or tax on capital gains: Nine states — alaska, florida, nevada, new hampshire, south dakota, tennessee, texas, washington and wyoming — have no income taxes.

Source: mapsoftheworldsnew.blogspot.com

Source: mapsoftheworldsnew.blogspot.com

States With No Tax Map Map Of The World, States levy no income tax: 2023 state income tax rates:

Source: prosperopedia.com

Source: prosperopedia.com

States That Have No Tax, Currently, seven states—alaska, florida, nevada, south dakota, tennessee, texas, and wyoming—don’t levy income taxes on individuals. Currently, the states with no individual income tax include:

Source: taxfoundation.org

Source: taxfoundation.org

State Corporate Tax Rates and Brackets for 2022 Tax Foundation, In addition to federal income tax, most states also collect state income tax. New hampshire (doesn’t tax earned wages, but does tax investment earnings) south dakota.

In Addition To Federal Income Tax, Most States Also Collect State Income Tax.

To be sure, the top marginal rate applies to any taxpayer earning more.

Best Tax Software For Customer Support.

The standard deduction for single filers rose to $13,850 for 2023, up $900;

See The Accompanying Gallery For The 15 States With The Highest Taxes, According To Wallethub.

Currently, the states with no individual income tax include:

Posted in 2024